- Free Consultation: 866-966-5240 Tap Here To Call Us

Mercury Insurance Claims Help: File, Track, And Get Support

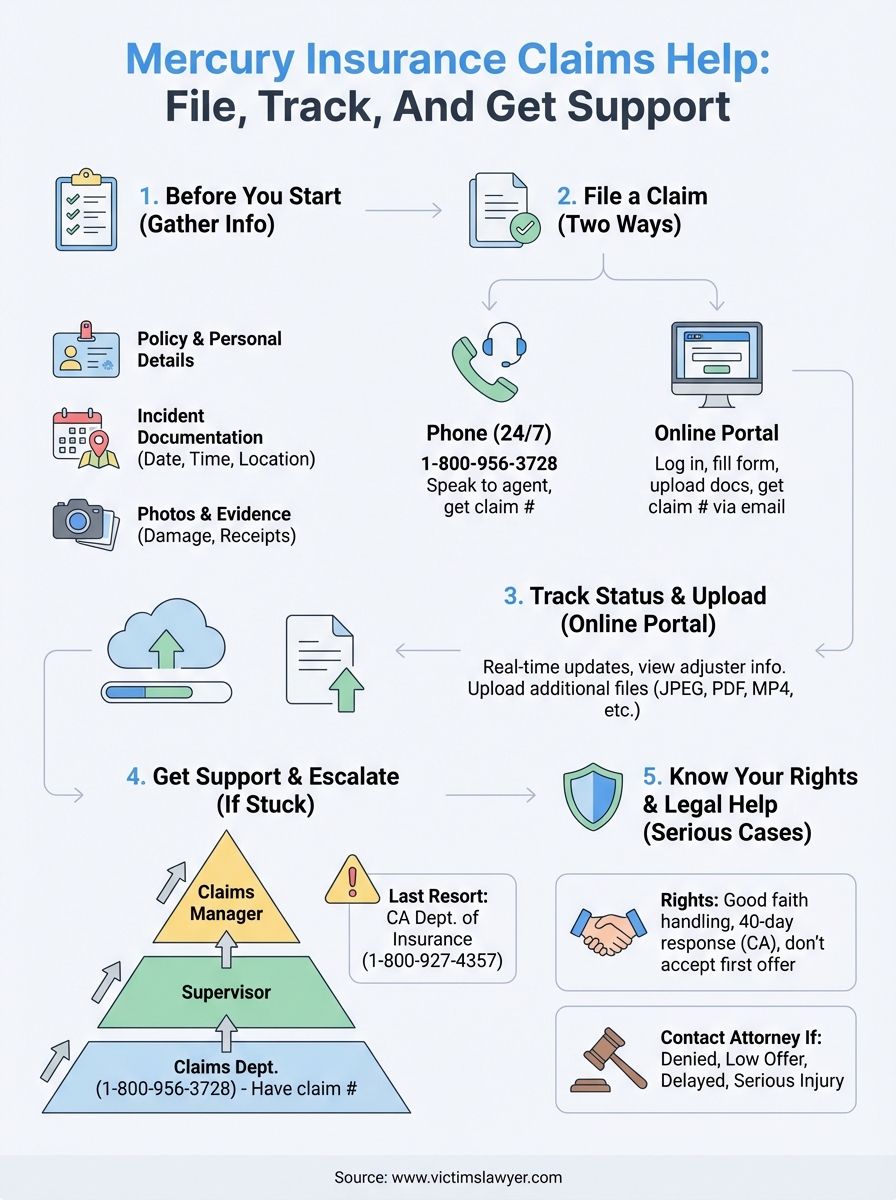

After an accident, dealing with insurance paperwork is the last thing you want on your plate. Whether you’ve been in a car crash, experienced property damage, or need to report another covered loss, understanding how to navigate Mercury Insurance claims can save you time and frustration. Getting your claim filed correctly from the start often determines how quickly you receive compensation.

This guide walks you through the complete process, from submitting your initial claim to tracking its status and reaching support when you hit a wall. We’ll cover Mercury’s contact numbers, online portal access, and the specific steps required to manage your claim effectively. And if your claim gets denied or you’re offered less than you deserve, our team at Steven M. Sweat, Personal Injury Lawyers, APC has spent over 25 years helping California accident victims recover fair compensation when insurance companies fall short. Sometimes knowing your options beyond the standard claims process makes all the difference in your recovery.

What you need before you start a Mercury claim

Before you contact Mercury Insurance to report your loss, gathering the right information upfront speeds up the entire process. Having your policy number, personal details, and incident documentation ready prevents delays and reduces the need for follow-up calls. Mercury’s claims team will ask specific questions about your accident or property damage, and preparation helps you provide accurate information from the start.

Policy and personal details

Your Mercury policy number appears on your insurance card, declarations page, or billing statements. Keep this number accessible along with the contact information for all parties involved in the incident, including names, phone numbers, addresses, and their insurance details if available. If you were in a vehicle accident, write down the other driver’s license plate number, driver’s license number, and vehicle make and model. For property claims, document the exact location where the damage occurred and when you first noticed it.

Incident documentation

Record the date, time, and location of the accident or loss as precisely as possible. Write down your account of what happened while the details remain fresh in your memory, including weather conditions, traffic patterns, or any other factors that contributed to the incident. If police or emergency services responded to the scene, obtain the report number and the responding officer’s name. Mercury will often request this official report during the claims investigation.

Document everything immediately after the incident, because memory fades and critical details become harder to recall even after a few days.

Photos and physical evidence

Take multiple photographs from different angles showing all damage to vehicles, property, or injuries. Capture wide shots that establish context and close-ups that show specific damage. If you have dashboard camera footage, security camera recordings, or witness statements, keep these files organized and accessible. For property damage, photograph the affected area before making any emergency repairs (though you should absolutely make necessary repairs to prevent further damage). Save all receipts related to the incident, including towing fees, rental car costs, temporary repairs, or medical expenses you paid out of pocket.

File a Mercury auto or home claim

Mercury gives you two primary methods to start your claim: calling their dedicated claims line or submitting through their online portal. Both options connect you directly to Mercury’s claims department, which operates around the clock for new accident reports. Choose the method that fits your situation best, keeping in mind that phone claims often work better for complex accidents where you need to explain detailed circumstances, while online submissions give you a written record of exactly what you reported.

Report by phone (24/7)

Call Mercury’s claims hotline at 1-800-956-3728 to speak with a claims representative any time of day or night. The agent will guide you through the reporting process and ask about the incident details, injuries, and damage you documented earlier. Have your policy number and the information you gathered ready before dialing. During the call, the representative assigns your claim a unique reference number and explains the next steps in Mercury’s investigation process.

Write down your claim number immediately and keep it accessible, because you’ll reference it in every future interaction with Mercury about this loss.

Submit online through your account

Log into your Mercury account at their website using your username and password, then navigate to the claims section. Click the option to file a new claim and complete the digital form with your incident details, uploading photos and documents as you go. The online system walks you through each required field and confirms your mercury insurance claims submission with an email containing your claim number and assigned adjuster information.

Track claim status and upload documents

Once Mercury assigns your claim number, you gain access to real-time updates throughout the investigation and settlement process. Checking your claim status regularly helps you stay informed about requests for additional information, adjuster appointments, and payment timelines. Mercury’s online portal serves as your central hub for monitoring progress and submitting supplementary materials without making phone calls or waiting on hold.

Check status through the online portal

Log into your Mercury account and click on the claims section to view all open and closed claims associated with your policy. The dashboard displays your claim status, assigned adjuster contact information, and any pending action items that require your attention. You’ll see updates when Mercury receives documents, schedules inspections, or processes payments. The portal also shows a timeline of activity on your mercury insurance claims, giving you visibility into what Mercury has done and what steps remain before settlement.

Upload additional documentation

Click the document upload button within your specific claim to attach files directly to your case. Mercury accepts common file formats including:

- JPEG, PNG, or PDF for photos and scanned documents

- MP4 or MOV for video evidence

- DOCX or PDF for medical records and repair estimates

Label each file clearly before uploading, using descriptions like “Front bumper damage” or “Emergency room bill January 15.” After submission, the portal confirms receipt and displays the uploaded documents in your claim file, typically within minutes of sending them.

Upload documents as soon as you receive them rather than waiting until Mercury requests them, because proactive submissions often speed up the review process.

Get customer support and escalate problems

When you hit roadblocks with your mercury insurance claims, knowing how to reach the right person prevents settlement delays. Mercury provides multiple support channels depending on your issue, and understanding the escalation path helps you move past unhelpful responses to connect with decision-makers.

Contact Mercury’s claims department directly

Call Mercury’s claims line at 1-800-956-3728 to speak with a representative about your open claim. Have your claim number ready along with specific details about what needs resolved. If your assigned adjuster hasn’t returned calls or emails within two business days, request to speak with their supervisor immediately. When calling, use this approach:

- State your name and claim number

- Explain the specific issue or delay

- Reference previous communication attempts

- Request a timeline for resolution

Document every conversation with Mercury by writing down the representative’s name, date, time, and summary of what was discussed.

Escalate to a supervisor or manager

Ask the claims representative to transfer you to a supervisor if you’re dissatisfied with the response or believe your claim is being handled unfairly. State clearly what resolution you expect and reference specific policy provisions that support your position.

If the supervisor doesn’t resolve your issue, request contact information for the claims manager overseeing your adjuster’s department. Mercury maintains a formal complaint process through the California Department of Insurance at 1-800-927-4357 if internal escalation fails to produce results.

Know your rights after an injury accident

California law gives you specific protections that extend beyond what insurance companies tell you during the mercury insurance claims process. Mercury must handle your claim in good faith, meaning they cannot unreasonably delay payments, deny valid claims without proper investigation, or pressure you into accepting inadequate settlements. You also have the right to seek medical treatment from any licensed provider you choose, regardless of Mercury’s preferred provider network.

Understanding insurance settlement obligations

Mercury must respond to your claim within 40 days under California Insurance Code Section 2695.7 and cannot force you to accept their first settlement offer. The company has a duty to investigate your claim thoroughly before denying coverage or reducing compensation. If you suffered injuries, you’re not required to provide a recorded statement without legal representation present, and Mercury cannot use your refusal against you.

Insurance companies work to minimize payouts, so understanding your legal protections prevents you from signing away rights to fair compensation.

When to involve a personal injury attorney

Contact a lawyer immediately if Mercury denies your claim, offers substantially less than your documented losses, or delays processing without valid reasons. Serious injuries including broken bones, traumatic brain injury, spinal damage, or permanent disability require legal evaluation because insurance settlements rarely account for future medical costs and lost earning capacity. Steven M. Sweat, Personal Injury Lawyers, APC provides free consultations to review your mercury insurance claims and determine if Mercury’s offer reflects the true value of your case.

Next steps

You now have the complete roadmap for handling your mercury insurance claims from initial filing through settlement. Start by gathering your policy information and incident documentation, then choose whether to file online or by phone based on your specific situation. Monitor your claim status regularly through Mercury’s online portal and upload supporting documents as you receive them to keep the process moving forward.

Remember that Mercury works for its own interests, not yours. If your claim gets denied, delayed beyond reasonable timeframes, or you receive a settlement offer that doesn’t cover your actual medical bills and lost wages, you need professional legal representation. Steven M. Sweat, Personal Injury Lawyers, APC has spent over 25 years fighting insurance companies that refuse to pay fair settlements to California accident victims.

Contact our Los Angeles office for a free consultation about your case. We work on contingency, which means you pay nothing unless we recover compensation for you. Your focus belongs on healing from your injuries, not wrestling with insurance adjusters.