- Free Consultation: 866-966-5240 Tap Here To Call Us

GEICO Claims Number: Phone Contacts And Claim ID Lookup

After an accident, getting your insurance claim moving quickly can mean the difference between financial recovery and mounting bills. Whether you need to report a new incident or check on an existing case, having the right GEICO claims number saves you time and frustration. GEICO handles millions of claims each year, and knowing exactly which department to call prevents you from bouncing between automated menus.

This guide provides all the direct phone contacts you need to reach GEICO’s claims department, along with step-by-step instructions for locating your 16-digit claim identification number. We’ll cover reporting new claims, checking claim status, and what to do if you’re having trouble getting through to a representative.

At Steven M. Sweat, Personal Injury Lawyers, APC, we’ve spent over 25 years helping accident victims in California navigate the claims process, and we’ve seen how insurance companies operate from the inside. While this resource helps you handle routine claim tasks, remember that serious injury claims often benefit from legal guidance before you provide recorded statements or accept settlement offers. Let’s start with the numbers you need.

What you need before contacting GEICO

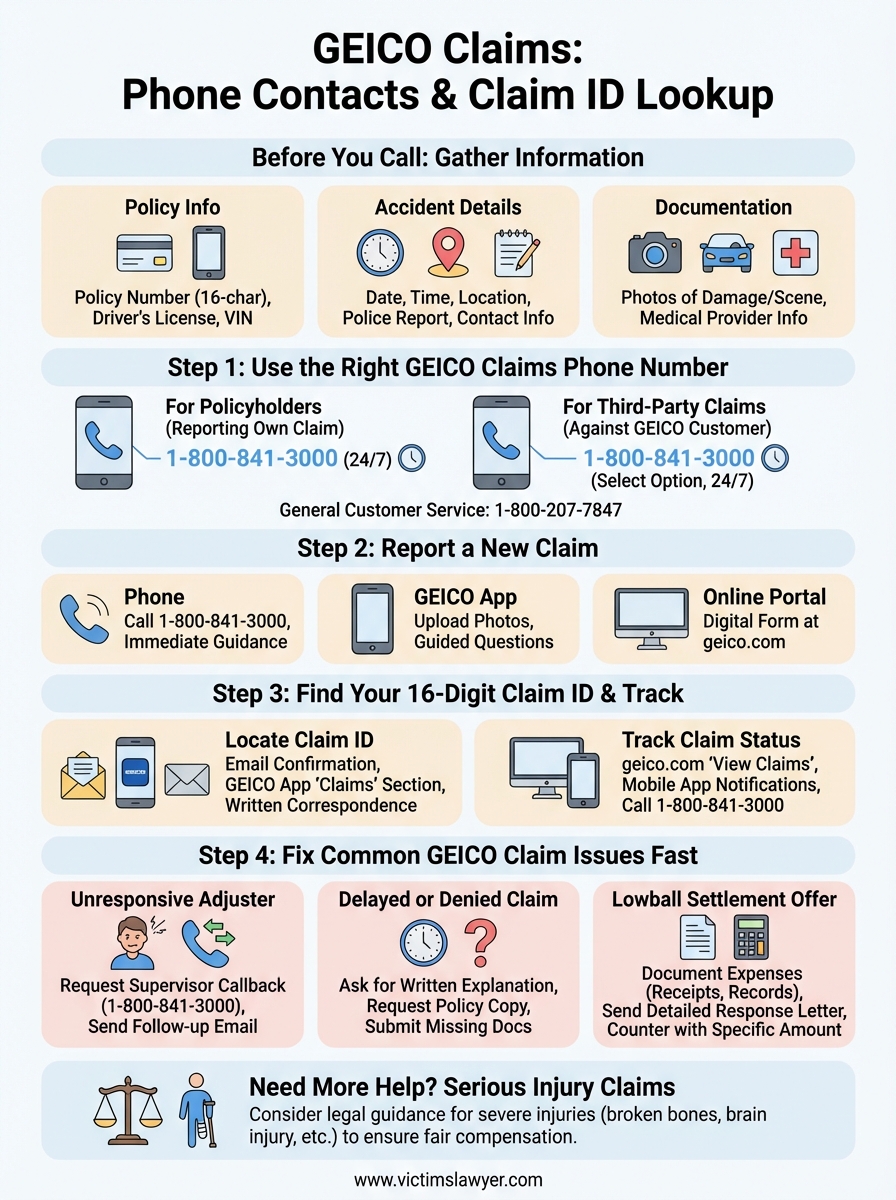

Before you dial the GEICO claims number, gathering the right information saves time and helps the claims adjuster start your case correctly. You’ll answer multiple questions during your first call, and having documents ready prevents you from needing to call back with missing details. GEICO representatives use your answers to determine coverage, assign fault, and set up inspections or medical authorizations.

Your GEICO policy information

You need your policy number handy before calling, which appears on your insurance card, billing statements, or in the GEICO mobile app. The claims department uses this 16-character identifier to pull up your coverage details and verify your active status. If you’re reporting a claim involving another driver’s policy, you’ll need their full name and policy number if they’re also insured by GEICO.

Keep your driver’s license number ready as well, since the representative will verify your identity against the policy records. Having the vehicle identification number (VIN) for the damaged car speeds up the process, especially if you insure multiple vehicles under one policy.

Details about the accident or incident

Write down the exact date, time, and location of the incident before you call. GEICO needs the street address or nearest intersection where the crash happened, not just a general area or neighborhood name. Include any police report number if law enforcement responded to the scene, as this helps the adjuster obtain official documentation.

Providing specific details during your first call prevents delays in claim processing and reduces the chance of coverage disputes later.

List the names and contact information for all drivers, passengers, and witnesses involved in the accident. You should have license plate numbers for every vehicle in the crash, along with insurance details for any non-GEICO drivers. Describe what happened in simple, factual terms without speculating about fault or apologizing for the incident.

Documentation and evidence

Take photos of vehicle damage from multiple angles before moving your car, if it’s safe to do so. Capture images showing the full accident scene, including traffic signs, road conditions, and final vehicle positions. These photos provide visual evidence that supports your statement and helps GEICO’s adjuster assess damage accurately.

If you received medical treatment, bring your healthcare provider’s name and contact information to the call. GEICO may need to verify injuries and set up direct billing arrangements with hospitals or doctors, so having this information ready accelerates medical claim processing and gets your bills paid faster.

Step 1. Use the right GEICO claims phone number

GEICO operates separate claim lines depending on whether you’re reporting your own accident or filing a claim against someone else’s GEICO policy. Calling the wrong number sends you through unnecessary transfers and adds wait time to an already stressful situation. The main GEICO claims number connects you to different departments based on your policy status, so you need to know which line handles your specific claim type before dialing.

For active GEICO policyholders

If you’re a current GEICO customer reporting damage to your own vehicle or property, call 1-800-841-3000 to reach the claims department directly. This line operates 24 hours a day, seven days a week, including holidays, and connects you to a claims representative who can start your case immediately. Have your policy number ready when you call, as the automated system prompts you for this information before routing your call.

You can also reach GEICO’s claims team by calling the main customer service line at 1-800-207-7847, though this number routes through additional menu options that add time to your call.

If you’re filing against a GEICO policyholder

When you’re not insured by GEICO but need to file a claim against their customer who damaged your property or injured you, call 1-800-841-3000 and select the option for third-party claims. The automated system asks whether you’re a policyholder before directing your call, so listen carefully to the prompts and choose the non-policyholder option to reach the right department.

| Claim Type | Phone Number | Hours |

|---|---|---|

| GEICO policyholder filing own claim | 1-800-841-3000 | 24/7 |

| Third-party claim against GEICO customer | 1-800-841-3000 | 24/7 |

| General customer service | 1-800-207-7847 | 24/7 |

Selecting the correct claim type when the automated system prompts you eliminates transfers and gets you speaking with a qualified adjuster faster.

Step 2. Report a new claim by phone, app, or online

GEICO gives you three ways to report a claim, and choosing the right method depends on how quickly you need to speak with an adjuster and what documentation you have available. Reporting by phone connects you with a representative immediately, while the app and online portal let you upload photos and submit details at your own pace. All three methods create your claim file in GEICO’s system, but phone claims typically get assigned to an adjuster faster than digital submissions.

Reporting by phone

Call the GEICO claims number at 1-800-841-3000 and follow the automated prompts to reach a claims representative. The adjuster walks you through each detail of the accident, asks about injuries, and schedules a vehicle inspection if needed. You receive a 16-digit claim number before the call ends, which you use to track your case and communicate with GEICO going forward. Phone reporting works best when you need immediate guidance or have questions about coverage during the reporting process.

Reporting by phone ensures you receive your claim number immediately and can ask questions about what happens next in your specific situation.

Using the GEICO mobile app

Download the GEICO Mobile app from your phone’s app store if you don’t already have it installed. Open the app, log into your account, and tap the “Report a Claim” button on the main screen. The app prompts you to upload photos directly from your phone’s camera, add accident details through guided questions, and submit your claim without calling. Your claim appears in the app’s “Claims” section within minutes, where you can view your assigned adjuster and claim status.

Filing online through the website

Log into your account at geico.com and click the “File a Claim” link in the navigation menu. You fill out a digital claim form that asks the same questions a phone representative would cover, including accident details, vehicle damage descriptions, and driver information. Upload photos through your computer or phone by dragging files into the upload boxes, then submit the completed form to create your claim.

Step 3. Find your 16-digit claim ID and track a claim

After you report an accident, GEICO assigns a 16-digit claim identification number that you need for all future communication about your case. This number appears in multiple places within GEICO’s system, and you’ll reference it when calling adjusters, submitting additional documentation, or checking your claim status. You can track your claim progress through three different channels, each providing real-time updates on inspections, payments, and settlement offers.

Where to locate your claim number

Check your email inbox for the confirmation message GEICO sends immediately after you file a claim, which includes your full claim ID in both the subject line and message body. Log into the GEICO mobile app and tap the “Claims” section to view all open claims with their associated identification numbers displayed at the top of each claim card. Your claim number also appears on any written correspondence GEICO mails to your address, including inspection reports and settlement letters.

Write down your claim number and store it somewhere accessible, since you’ll need to provide it every time you contact GEICO about your case.

Checking claim status online or by phone

Access your claim details through the GEICO website by logging into your account and clicking “View Claims” in the main menu, which displays your current claim status, assigned adjuster contact information, and any pending actions you need to complete. The mobile app provides the same information with push notifications when your claim status changes or your adjuster needs additional documentation from you.

Call the geico claims number at 1-800-841-3000 to speak with a representative about your claim status if you prefer phone updates. Have your 16-digit claim ID ready when you call, and the automated system routes you directly to your assigned adjuster’s department after you enter the number on your keypad.

Step 4. Fix common GEICO claim issues fast

Even with all the right numbers and documentation, claim processing problems still pop up during GEICO cases. You might face delayed inspections, unreturned calls from adjusters, or settlement offers that don’t cover your actual damages. These issues frustrate accident victims who need their vehicles repaired and medical bills paid, but most problems have straightforward solutions if you know which department handles your specific concern.

When you can’t reach your adjuster

Request a supervisor callback by calling the geico claims number at 1-800-841-3000 and asking the automated system or representative to escalate your case. Provide your 16-digit claim ID and explain that you’ve left multiple messages without response, which typically triggers a supervisor review within 24 hours. Send a follow-up email to your adjuster using the contact information in your claim portal, copying the supervisor’s email address if you have it.

Escalating to a supervisor creates a paper trail and often speeds up response times when your assigned adjuster is overwhelmed with other cases.

If your claim is delayed or denied

Ask for a written explanation specifying exactly which policy provision GEICO believes applies to the delay or denial. Request a copy of your full policy document if you don’t already have it, since this shows what coverage you paid for and helps you identify incorrect interpretations. Submit any missing documentation through the mobile app or website immediately, as incomplete files cause most legitimate claim delays rather than coverage disputes.

Handling lowball settlement offers

Document all your actual expenses with receipts and medical records that show costs exceeding GEICO’s initial offer. Send a detailed response letter listing each expense item they underpaid or omitted, attaching supporting documentation as proof. Counter with a specific dollar amount based on your documented losses rather than accepting their first settlement number, which typically leaves room for negotiation.

If you need more help after a crash

Having the geico claims number and knowing how to navigate the claims process helps you handle straightforward vehicle damage and minor injury cases. You can report accidents, track claim status, and communicate with adjusters using the phone contacts and claim ID lookup methods we covered in this guide. Most fender benders and property damage claims resolve without complications when you follow these steps.

Serious injury cases require different considerations that go beyond filing insurance paperwork. If you suffered broken bones, traumatic brain injury, spinal damage, or permanent disability, the insurance company’s first settlement offer rarely covers your actual medical costs and lost wages. Insurance adjusters work for their company’s financial interests, not yours, and they train to minimize payouts on high-value claims.

Steven M. Sweat, Personal Injury Lawyers, APC provides free case evaluations for California accident victims dealing with severe injuries. We handle negotiations with GEICO and other insurers while you focus on recovery, and we charge no legal fees unless we secure money for your case.