- Free Consultation: 866-966-5240 Tap Here To Call Us

Farmers Insurance Claims: How To File And Track Status

After an accident, dealing with your insurance company becomes an immediate priority. If you’re a Farmers Insurance policyholder, or if the at-fault party carries Farmers coverage, understanding how to navigate Farmers Insurance claims can make a significant difference in your recovery. With over 19 million policies in force nationwide, there’s a strong chance you’ll encounter this insurer at some point.

Filing a claim correctly and tracking its progress are essential steps toward getting the compensation you need for medical bills, lost wages, and other damages. However, insurance companies are businesses with a focus on protecting their bottom line, which sometimes means denying valid claims or offering settlements far below what victims actually deserve. At Steven M. Sweat, Personal Injury Lawyers, APC, we’ve spent over 25 years helping California accident victims hold insurers accountable when claims hit roadblocks.

This guide covers everything you need to know: how to file a claim with Farmers Insurance, the different ways to check your claim status, and the direct contact numbers for their claims department. We’ll also explain when bringing in a personal injury attorney can help you secure a fair outcome, especially if Farmers isn’t treating your claim with the urgency it deserves.

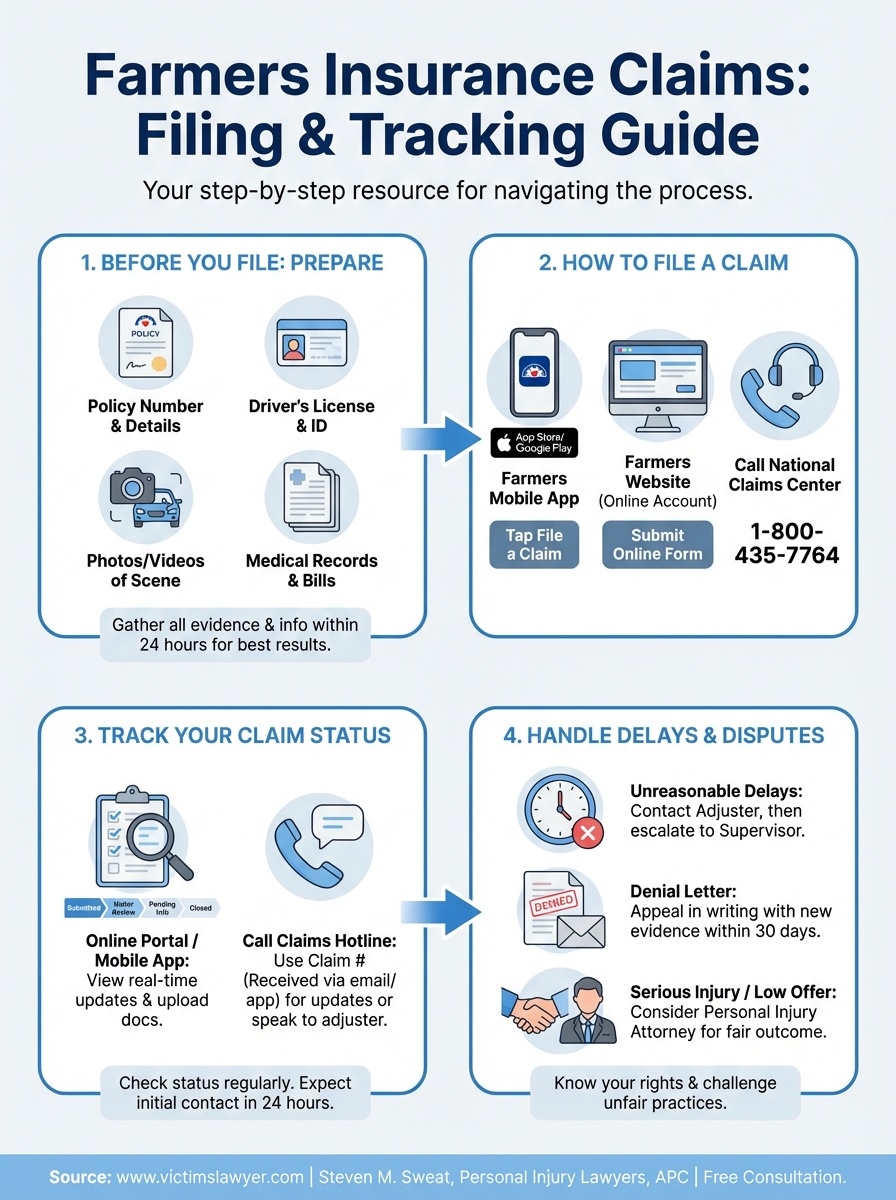

Before you file: what to gather and what to know

Proper preparation makes the claims process smoother and helps prevent unnecessary delays. Before you contact Farmers Insurance, collect every piece of evidence and documentation related to your incident. Having these materials ready ensures you can provide accurate information from the start, which speeds up processing and strengthens your claim.

Essential documents and information to collect

You need to gather specific items before making your first call. Start with your Farmers Insurance policy number, which appears on your declarations page or insurance card. Then collect your driver’s license (or other government-issued ID) and the date, time, and exact location where the incident occurred.

Next, compile all evidence from the scene. This includes photos or videos of property damage, injuries, road conditions, and any visible hazards. You should also obtain the police report number if law enforcement responded to the accident. Additionally, gather contact information and insurance details for all other parties involved, plus names and phone numbers of any witnesses who saw what happened.

Documentation collected within the first 24 hours carries more weight than evidence assembled weeks later.

Your policy details and coverage limits

Review your policy declarations page before filing farmers insurance claims to understand what coverage applies to your situation. Check your liability limits, collision deductibles, and whether you carry comprehensive, uninsured motorist, or medical payments coverage. Different types of claims tap into different sections of your policy, and knowing these details prevents surprises when settlement discussions begin.

Your policy also outlines time limits for reporting claims. Most policies require notification within a reasonable timeframe, typically 24 to 72 hours after an accident. Missing these deadlines can give Farmers grounds to deny your claim entirely.

Medical records and expense tracking

If you sustained injuries, start tracking all medical expenses immediately. Keep copies of emergency room bills, ambulance invoices, prescription receipts, and any documentation from follow-up appointments. You should also record lost wages by requesting written statements from your employer showing missed work days and salary reductions. These financial records form the foundation of your compensation demand, so maintain organized files with dates, amounts, and service descriptions for every expense related to your accident.

Step 1. File a Farmers Insurance claim

You can report your claim to Farmers Insurance through three primary channels, each available 24 hours a day. Choose the method that fits your situation best, keeping in mind that filing quickly protects your rights under your policy and starts the claims process immediately.

Contact methods for filing

Call Farmers directly at 1-800-435-7764 to speak with a claims representative who will guide you through the initial report. This number connects you to their national claims center, where you can file any type of claim regardless of where you live in the United States.

Alternatively, log into your account at the Farmers Insurance website and navigate to the claims section to submit your report online. The digital form walks you through each required field step by step. You can also download the Farmers Mobile App (available for iOS and Android) and tap “File a Claim” from the home screen to complete the entire process from your phone.

Filing within 24 hours gives adjusters the best chance to inspect fresh evidence before it disappears.

Information you need to provide

During your initial report, you’ll answer specific questions about the incident. Provide your policy number, the exact date and time of the accident, and the precise location including street names or intersections. Describe what happened in clear terms without speculating about fault or making statements that could hurt your claim later.

You’ll also need to share contact and insurance information for all other parties involved, along with the police report number if applicable. If you took photos at the scene, mention this to the representative. They’ll note it in your file and request you upload these images through your online account or the mobile app.

Step 2. Track your claim status and updates

Once Farmers processes your initial report, they assign a claim number and an adjuster to your case. You receive these details via email or through the Farmers mobile app within 24 hours of filing. Checking your claim status regularly keeps you informed about progress, requests for additional documentation, and settlement offers. Staying proactive prevents delays and ensures you respond quickly when the adjuster needs more information from you.

Online tracking through your account

Log into your Farmers Insurance account at their website or open the mobile app to view real-time claim updates. Navigate to the “Claims” section and click on your active claim number to see the current status, which typically shows as “Submitted,” “Under Review,” “Pending Information,” or “Closed.” The dashboard displays recent activity, including adjuster notes, requested documents, and estimated timelines for the next steps in your case.

You can also upload additional photos, medical records, or repair estimates directly through the online portal. This feature speeds up the review process because your adjuster receives files instantly rather than waiting for mail or fax transmissions.

Checking your claim status twice per week catches requests for information before they delay your settlement.

Phone updates and claim representative contact

Call the Farmers claims hotline at 1-800-435-7764 and provide your claim number when prompted. The automated system gives you basic status updates, or you can press the option to speak with a representative who accesses detailed notes from your adjuster. You can also contact your assigned adjuster directly using the phone number listed in your initial claim confirmation email for specific questions about coverage, settlement amounts, or inspection schedules.

Step 3. Work with the adjuster and document losses

Your adjuster becomes your primary point of contact throughout the farmers insurance claims process. This person investigates your accident, evaluates damages, and determines settlement amounts based on your policy coverage. Cooperation with your adjuster speeds up resolution, but you need to protect your interests by maintaining thorough documentation of every loss you claim. Understanding what adjusters look for and organizing your records properly prevents undervalued settlements.

What adjusters evaluate and request

Adjusters review all property damage first, typically by scheduling an inspection of your vehicle or requesting repair estimates from approved body shops. They also examine your medical treatment records to confirm injuries relate directly to the accident. You must provide these materials promptly when requested, along with proof of lost income through pay stubs and employer statements showing missed work days.

Your adjuster may ask for a recorded statement describing how the accident happened. You have the right to decline this request or have an attorney present before giving any recorded interview. Statements made early in the process can hurt your claim if you discover additional injuries later or remember new details about the incident.

Creating a loss documentation system

Build a spreadsheet or document tracking every expense related to your accident. Create columns for the date, expense type, amount, and receipt number. Record each medical appointment, prescription, therapy session, and rental car day in separate rows with supporting documentation attached.

| Date | Expense Type | Amount | Receipt # |

|---|---|---|---|

| 01/15/2026 | Emergency Room | $2,847 | ER-00123 |

| 01/18/2026 | Prescription | $85 | RX-456 |

| 01/22/2026 | Physical Therapy | $150 | PT-789 |

Organized documentation shows adjusters you take your claim seriously and makes disputing low offers easier.

Submit copies of receipts to your adjuster weekly rather than waiting until the end of treatment.

Step 4. Handle delays, denials, and disputes

Insurance companies sometimes drag out farmers insurance claims hoping you’ll accept a low settlement or give up entirely. Farmers might request excessive documentation, schedule multiple inspections, or simply stop responding to your calls. You have specific rights when delays stretch beyond reasonable timeframes, and knowing how to challenge denials protects your financial recovery.

Recognizing unreasonable delays and taking action

Contact your assigned adjuster immediately if you haven’t received updates in more than two weeks. Document each attempt to reach them by noting the date, time, and method of contact. If your adjuster remains unresponsive, escalate to their supervisor by calling the main claims line at 1-800-435-7764 and requesting management intervention.

California law requires insurers to acknowledge claims within 15 days and accept or deny them within 40 days after receiving all requested documentation. You can file a complaint with the California Department of Insurance at 800-927-4357 if Farmers violates these timeframes. State regulators investigate bad faith practices and can force the company to process your claim properly.

Filing a regulatory complaint often motivates insurers to resolve stalled claims within days rather than weeks.

Responding to denial letters with appeals

Read your denial letter carefully to identify the specific policy provision Farmers cites as grounds for rejection. You have the right to appeal this decision by submitting a written response within 30 days that includes new evidence or explains why their interpretation of your policy is incorrect. Attach medical records, repair estimates, or witness statements that directly contradict their reasoning for denial.

Consider hiring an attorney if Farmers denies a claim worth more than $10,000 or involving serious injuries. Legal representation forces adjusters to justify their decisions and often results in reversed denials or substantially higher settlement offers.

What to do next

You now know how to file farmers insurance claims, track their progress through online portals or phone updates, and respond when adjusters delay or deny your case. Following these steps puts you in control of the process and helps you document losses properly from day one. Most claims settle within 30 to 60 days when you stay organized and maintain regular communication with your assigned adjuster.

However, some situations require professional legal help. If Farmers denies your claim unfairly, offers a settlement far below your actual damages, or stops responding to your calls, you need an attorney who understands insurance bad faith tactics. At Steven M. Sweat, Personal Injury Lawyers, APC, we’ve secured hundreds of millions in verdicts and settlements for California accident victims over the past 25 years. Contact us for a free consultation to discuss your claim, especially if you’re facing serious injuries or mounting medical bills that Farmers refuses to cover properly.