- Free Consultation: 866-966-5240 Tap Here To Call Us

Liberty Mutual Claims: How To File, Track, And Get Help

After an accident, dealing with insurance companies becomes an immediate priority. Liberty Mutual claims can seem straightforward on the surface, but the process often involves unexpected hurdles, delays, confusing paperwork, and settlement offers that may not fully cover your medical bills, lost wages, or property damage.

At Steven M. Sweat, Personal Injury Lawyers, APC, we’ve spent over 25 years helping California accident victims navigate insurance claims and fight for fair compensation. We’ve seen firsthand how understanding the claims process gives you leverage and how being prepared from the start can significantly impact your final outcome.

This guide walks you through everything you need to know about filing, tracking, and getting help with your Liberty Mutual claim. You’ll learn how to access the online portal, find the right customer support contacts, and recognize when bringing in legal help might be necessary to protect your interests and maximize your recovery.

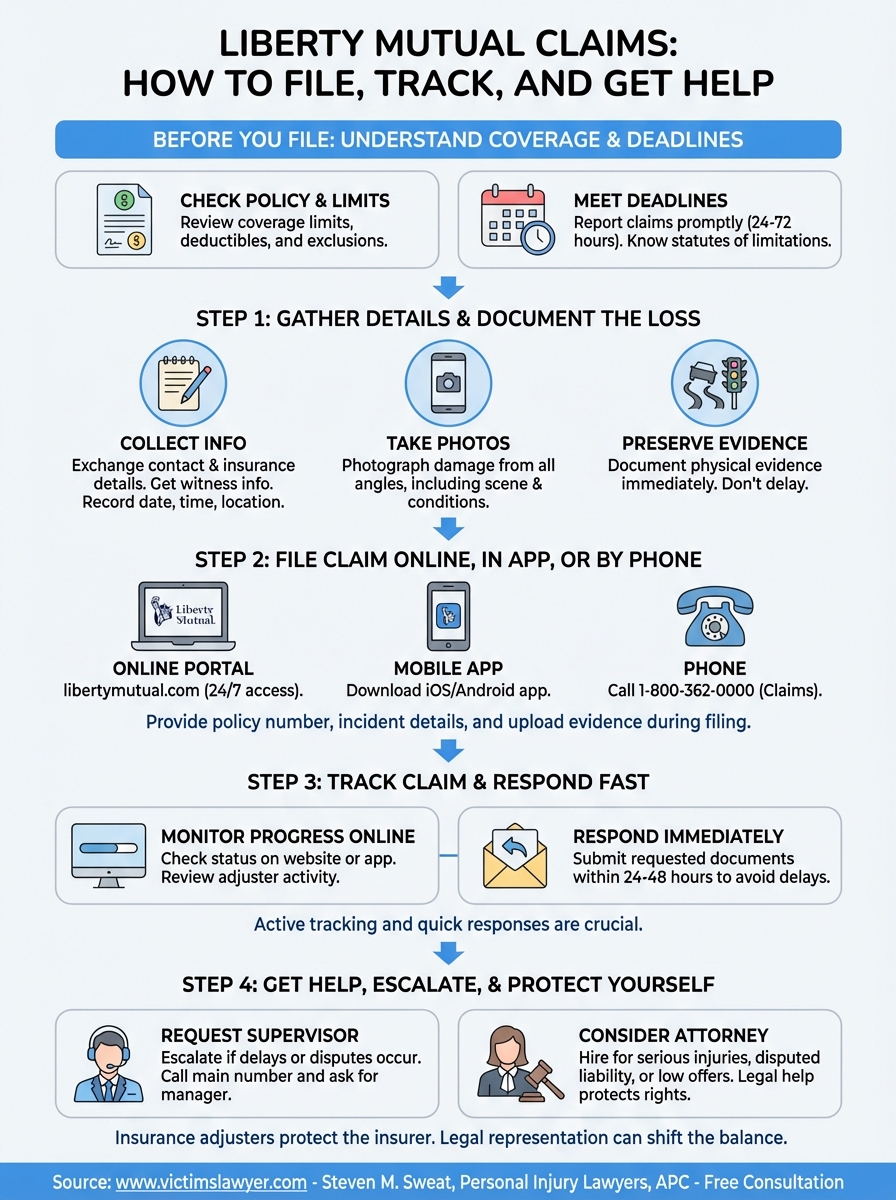

What to know before you file a Liberty Mutual claim

Before you contact Liberty Mutual, you need to understand your policy coverage and what’s at stake. Your insurance policy acts as a contract, and knowing your coverage limits, deductibles, and exclusions determines what compensation you can realistically expect. Many people discover too late that their policy doesn’t cover certain types of damage or that their coverage limits fall short of their actual losses.

Check your policy coverage and deadlines

Pull out your policy documents and review the specific coverage that applies to your situation. Auto policies typically include liability, collision, comprehensive, and potentially uninsured motorist coverage, each with different limits. Your deductible amount directly affects your out-of-pocket costs, and certain exclusions might prevent coverage altogether.

Liberty Mutual requires you to report claims within a reasonable timeframe, typically within 24 to 72 hours of an incident. California law also imposes statutes of limitations that restrict how long you have to file a lawsuit if settlement negotiations fail. For personal injury claims, you generally have two years from the date of injury, though exceptions exist.

Missing filing deadlines can result in a denied claim or forfeited right to sue, regardless of how strong your case might be.

Understand when you need legal representation

Insurance companies, including Liberty Mutual, employ trained adjusters whose job involves minimizing payouts. If your injuries require ongoing medical treatment, if liability remains disputed, or if the initial settlement offer seems inadequate, bringing in an experienced attorney protects your rights. Legal representation becomes particularly important for liberty mutual claims involving serious injuries, permanent disability, or wrongful death.

Step 1. Gather details and document the loss

The strength of your liberty mutual claims depends on the evidence you collect immediately after an accident. Liberty Mutual adjusters base their evaluations on documented proof, not just your verbal account of what happened. The more thorough your documentation, the harder it becomes for the insurer to dispute your version of events or undervalue your damages.

Collect information at the scene

Start by gathering contact and insurance details from all parties involved, including names, phone numbers, license plate numbers, and policy information. You also need to document witness information since third-party statements can prove crucial if liability becomes disputed.

Record these essential details:

- Date, time, and exact location of the incident

- Weather and road conditions

- Names and badge numbers of responding police officers

- Description of how the accident happened

- Vehicle damage locations and severity

- Injuries you notice immediately

Take photos and preserve evidence

Use your phone to photograph vehicle damage from multiple angles, showing both close-ups and wide shots that capture the surrounding area. Take pictures of street signs, traffic signals, skid marks, and any other physical evidence that helps establish fault or conditions.

Documentation you gather in the first 24 hours often proves more valuable than anything you try to reconstruct weeks later.

Step 2. File your claim online, in the app, or by phone

Once you’ve gathered your documentation, you can file your liberty mutual claims through three different channels. Liberty Mutual provides multiple filing options to accommodate your schedule and preference, whether you want immediate online access, mobile convenience, or direct phone support with a live representative.

Choose your filing method

Liberty Mutual gives you flexibility in how you initiate your claim. The online claims portal at libertymutual.com allows 24/7 access and typically processes faster than phone submissions. You can also download the Liberty Mutual mobile app for iOS or Android, which lets you file, upload photos, and track everything from your phone.

If you prefer speaking with someone directly, call 1-800-362-0000 for property and auto claims or 1-800-225-2467 for general inquiries. Phone representatives can guide you through the process and answer questions immediately.

Filing online or through the app creates an instant digital record with timestamps, which can protect you if disputes arise later.

What to provide during filing

When you submit your claim, Liberty Mutual requires your policy number, date and location of the incident, and a detailed description of what happened. You’ll also need to provide contact information for all involved parties, police report numbers if applicable, and any photos or documentation you collected at the scene.

Upload all available evidence during your initial filing rather than submitting it piecemeal later.

Step 3. Track your claim and respond fast

After filing your liberty mutual claims, you need to monitor progress closely and respond to any requests within 24 to 48 hours. Liberty Mutual assigns a claims adjuster to investigate your case, and delays in your responses can slow down processing or give the insurer reasons to deny certain expenses. Active tracking keeps you informed and positions you to challenge lowball offers before they become final.

Access your claim status online

Log into the Liberty Mutual website or mobile app using your policy credentials to view real-time updates on your claim status. The portal displays your assigned adjuster’s contact information, recent activity on your file, and any pending requests for additional documentation.

Check your claim dashboard at least every 2 to 3 days for:

- Status changes (under review, approved, denied, pending information)

- Adjuster notes or messages requesting follow-up

- Scheduled inspection or appraisal dates

- Payment processing updates

Respond to requests immediately

When your adjuster asks for medical records, repair estimates, or additional photos, submit everything within the timeframe they specify. Missing deadlines gives Liberty Mutual grounds to delay or reduce your settlement, claiming you failed to cooperate with their investigation.

Fast responses prevent adjusters from using your delays as leverage to lower settlement offers.

Save copies of everything you submit and document when you sent it.

Step 4. Get help, escalate, and protect yourself

When your liberty mutual claims adjuster delays responses, disputes valid expenses, or offers a settlement far below your actual damages, you need to take immediate action. Liberty Mutual employs internal escalation procedures that often resolve disputes without litigation, but knowing when to bring in legal representation protects your financial recovery and prevents you from accepting inadequate compensation.

Request a supervisor or claims manager

Start by asking for your adjuster’s direct supervisor or the claims department manager. Call the main Liberty Mutual number at 1-800-362-0000 and state clearly that you want to escalate your claim due to delays, disputed charges, or an unreasonable settlement offer.

Document every escalation attempt with:

- Name and title of the supervisor you speak with

- Date and time of your conversation

- Specific issues you raised

- Any promises or timelines they commit to

Hire an attorney for serious or disputed claims

If Liberty Mutual denies your claim, disputes fault, or refuses to cover medical treatment you believe falls under your policy, contact a personal injury attorney immediately. Legal representation becomes critical when your injuries require long-term care, when liability remains contested, or when settlement offers don’t account for future medical expenses.

Attorneys operate on contingency, meaning you pay nothing upfront and only if they recover money for you.

Next steps

You now have a roadmap for handling liberty mutual claims from initial filing through settlement negotiations. Following these steps gives you better control over the process and helps you avoid common mistakes that weaken your position.

Insurance companies protect their bottom line first. Liberty Mutual adjusters work for the insurer, not for you, which means their primary goal involves minimizing payouts whenever possible. If you suffered serious injuries, face disputed liability, or received a settlement offer that doesn’t cover your full losses, legal representation shifts the balance in your favor.

At Steven M. Sweat, Personal Injury Lawyers, APC, we’ve recovered hundreds of millions of dollars for California accident victims over 25 years. Our team operates on contingency, meaning you pay nothing unless we win your case. Contact us today for a free consultation to review your claim and protect your right to fair compensation.