- Free Consultation: 866-966-5240 Tap Here To Call Us

Insurance Claim Lawyer Near Me: How to Choose The Right One

When an insurance company denies your claim, delays payment, or offers far less than you deserve, the frustration can feel overwhelming. You paid your premiums. You followed the rules. And now, when you actually need coverage, you’re getting the runaround. If you’ve searched for an insurance claim lawyer near me, you’re likely dealing with this exact situation, and you’re right to seek professional help.

Insurance companies have teams of adjusters and attorneys working to protect their bottom line, not your best interests. Fighting back on your own rarely works in your favor. At Steven M. Sweat, Personal Injury Lawyers, APC, we’ve spent over 25 years taking on insurance companies across California, recovering hundreds of millions of dollars for clients who were wrongfully denied or underpaid. We understand how these companies operate and what it takes to hold them accountable.

This guide will walk you through what an insurance claim lawyer does, when you need one, and how to choose the right attorney for your situation. By the end, you’ll have a clear path forward to protect your rights and pursue the compensation you’re owed.

Why an insurance claim lawyer can change your outcome

Insurance companies employ trained professionals whose job is to minimize payouts. When you hire an attorney, you bring an experienced advocate into the process who knows how to counter their tactics. Lawyers understand the true value of your claim, including damages you might not have considered, and they know which legal strategies force insurers to pay what they owe.

Lawyers level the playing field

Adjusters use delay tactics, request excessive documentation, and make lowball offers hoping you’ll give up or settle for less. Without legal representation, you’re negotiating against professionals who do this every day. An insurance claim lawyer near me can dismantle these strategies because they’ve seen them hundreds of times before. They know when an insurer is acting in bad faith and which legal pressure points will move your case forward.

Your attorney becomes the barrier between you and aggressive insurance tactics designed to wear you down.

They maximize your settlement value

Most people underestimate what their claim is worth. You might focus on immediate medical bills but overlook future treatment costs, lost earning capacity, or pain and suffering damages. Attorneys calculate the full economic and non-economic impact of your injury or loss, then build a case that documents every dollar. They also know when to reject an offer and push for litigation, which often results in substantially higher compensation than initial settlement proposals.

Lawyers also handle all communication with the insurance company, removing the emotional burden from you while protecting you from saying something that could hurt your case.

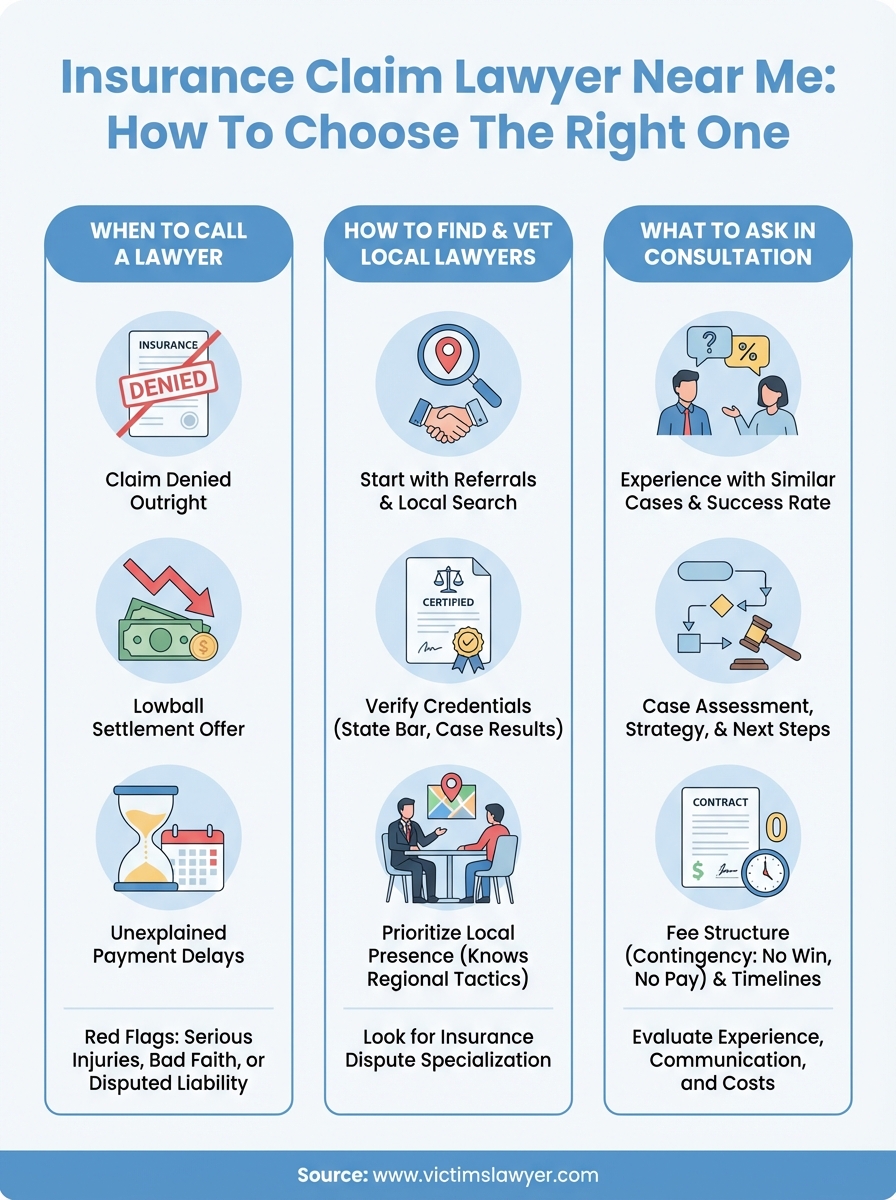

When to call a lawyer for an insurance claim

Not every insurance dispute requires an attorney, but certain situations demand professional legal intervention. You should contact a lawyer when the insurance company denies your claim outright, offers a settlement that doesn’t cover your actual damages, or delays payment without valid reason. These red flags signal that the insurer may be acting in bad faith or hoping you’ll accept less than you deserve.

Your claim involves serious injuries or significant losses

Complex cases require legal expertise. If your accident resulted in permanent disability, scarring, traumatic brain injury, or wrongful death, the financial stakes are too high to navigate alone. Insurance companies lowball catastrophic injury claims because they know victims are vulnerable and desperate for money. An insurance claim lawyer near me can calculate the full value of lifelong medical care, lost earning capacity, and non-economic damages that adjusters won’t voluntarily include.

Serious injuries require serious legal representation to secure compensation that matches the true impact on your life.

The insurance company acts in bad faith

Bad faith occurs when insurers intentionally avoid their contractual obligations. This includes unreasonable investigation delays, demanding excessive documentation, misrepresenting policy language, or refusing to communicate. When you recognize these patterns, legal action becomes necessary to hold the company accountable and recover damages beyond your policy limits.

How to find and vet a local insurance claim lawyer

Start with referrals from people you trust who have handled similar claims. Personal recommendations reveal real experience with specific attorneys. You can also search for “insurance claim lawyer near me” to find local options, but don’t stop at the first result. Check your state bar association’s website, which lists licensed attorneys and any disciplinary actions.

Verify credentials and experience

Look for attorneys who specialize in insurance disputes rather than general practice. Check their website for case results, client testimonials, and years in practice. Your state bar website confirms their license status and any complaints filed against them. Call their office and ask about their experience with cases like yours and their success rate.

The right lawyer should have a proven history of fighting insurance companies, not just processing paperwork.

Prioritize local presence

Choose an attorney who practices in your area and understands local court systems. Local lawyers know regional insurance company tactics and have relationships that can benefit your case. They can also meet you in person when discussing sensitive details or signing documents.

What to ask in a free consultation

The initial consultation gives you direct access to evaluate an attorney before committing. You should prepare specific questions that reveal their experience, approach, and whether they’re the right fit for your case. This meeting isn’t just for them to assess your claim, it’s your opportunity to interview them and determine if you feel confident moving forward together.

Questions about their experience

Ask how many insurance claim cases they’ve handled similar to yours and what their success rate looks like. You want specific numbers, not vague promises. Find out if they’ve litigated against your insurance company before and what strategies worked. Request examples of recent settlements or verdicts they’ve secured. Their answers should demonstrate familiarity with the tactics your insurer uses and proven methods to counter them.

An experienced attorney should answer these questions confidently with concrete examples, not marketing language.

Questions about your case and next steps

Request their honest assessment of your claim’s strengths and weaknesses. Ask what evidence you need to gather and what the likely timeline looks like. Find out who will actually handle your case, because some firms assign consultations to senior attorneys but pass the work to junior staff. Clarify how often you’ll receive updates and through which communication channels.

Costs, timelines, and what to expect next

Most personal injury attorneys work on contingency, meaning you pay nothing upfront and legal fees come from your settlement. If the attorney doesn’t win your case, you don’t pay them. This structure removes financial barriers and ensures your insurance claim lawyer near me has motivation to maximize your recovery. Some firms also cover case expenses like expert witnesses or filing fees, then deduct those costs from the final settlement.

Fee structures and out-of-pocket costs

Contingency percentages typically range from 33% to 40% of your settlement, depending on whether your case settles or goes to trial. Your attorney should explain their fee structure clearly during the consultation. Ask about additional costs like medical record retrieval, court filing fees, or expert testimony, and whether these come out of your pocket or the settlement proceeds. Understanding the complete financial picture prevents surprises later.

The right attorney invests in your case because they believe in your right to compensation.

Timeline expectations

Insurance claim resolution typically takes three to 18 months, depending on case complexity and the insurance company’s cooperation. Simple claims with clear liability settle faster, while disputed or high-value cases require longer investigation and negotiation. Your attorney should provide a realistic timeline based on your specific situation and keep you updated as negotiations progress.

Next steps

You now understand when to hire an insurance claim lawyer near me, how to find the right attorney, and what questions separate qualified advocates from generic legal firms. The next action depends on where your claim stands. If your insurance company has denied coverage, offered a settlement that doesn’t cover your losses, or dragged out the process without explanation, contact an experienced attorney immediately. Every day you wait gives the insurance company more time to build their defense.

At Steven M. Sweat, Personal Injury Lawyers, APC, we offer free consultations 24/7 to review your case and explain your legal options. Our team has spent over 25 years fighting insurance companies throughout California, and we work on contingency, meaning you pay nothing unless we recover compensation for you. Don’t let an insurance company take advantage of your situation. Reach out to our Los Angeles personal injury lawyers today and let us protect your rights.