- Free Consultation: 866-966-5240 Tap Here To Call Us

How Long Do Car Accident Settlements Take in California?

After a car accident, your life becomes a waiting game. You’re waiting for medical appointments, waiting for insurance adjusters to return calls, and constantly wondering how long do car accident settlements take to finally resolve. It’s one of the most common questions clients bring to Steven M. Sweat, Personal Injury Lawyers, APC, and after 25+ years handling these cases across California, we can tell you the answer depends on your specific circumstances.

The timeline for a California car accident settlement hinges on several factors: the severity of your injuries, how clearly liability can be established, whether you’ve completed medical treatment, and the willingness of insurance companies to negotiate in good faith. Some straightforward cases settle within a few months, while complex claims involving catastrophic injuries or disputed fault may take a year or longer to reach fair resolution.

This guide breaks down realistic timelines for car accident settlements in California and explains exactly what can accelerate or delay your case. You’ll learn which phases of the process take the most time, what you can control versus what you can’t, and how to recognize when patience serves your financial interests, versus when it’s time to file a lawsuit and push harder for the compensation you deserve.

Why car accident settlement timing varies

No two car accident cases follow the same timeline because every case combines different injuries, insurance companies, and legal complications. When clients ask how long do car accident settlements take, we start by evaluating the specific factors that will control their case speed. The reality is that rushing to settle before you understand your full damages almost always costs you tens of thousands of dollars in compensation you can never recover later.

Your medical treatment status drives the calendar

You cannot finalize a settlement until your medical team declares you’ve reached maximum medical improvement (the point where doctors believe you’ve healed as much as possible). Settling before this milestone means you’re guessing at future medical costs, and insurance companies love when accident victims underestimate their needs. If you accept $50,000 today but require $80,000 in spine surgery next year, you’re stuck with the difference. Most soft tissue injuries stabilize within three to six months, but traumatic brain injuries, spinal damage, or fractures requiring multiple surgeries can keep you in treatment for a year or longer.

Insurance adjusters pressure you to settle quickly because they know your bills are mounting and your patience is running thin.

Continuing medical care also strengthens your settlement value because it creates a documented trail of pain, limitations, and expenses that adjusters cannot easily dismiss. The longer you treat with consistent medical visits, the harder it becomes for the insurance company to claim your injuries were minor or unrelated to the accident.

Liability clarity affects negotiation speed

Cases where fault is obvious (rear-end collisions, clear red light violations caught on camera) move faster than accidents involving multiple parties or conflicting witness statements. When liability is disputed, insurance companies use that ambiguity to delay payments while they investigate whether you share any responsibility under California’s comparative negligence laws. A drunk driver who crosses the centerline and hits you head-on creates a straightforward liability picture that often leads to quicker settlement discussions. Intersection crashes where both drivers claim the green light, or parking lot accidents with no witnesses, require more investigation and sometimes depositions before insurers agree to reasonable offers.

Policy limits and coverage layers add complexity

Simple cases with one defendant, one insurance policy, and damages below the policy limits settle faster than claims requiring multiple coverage sources. If the at-fault driver carries only California’s minimum $15,000 bodily injury coverage but you suffered $200,000 in damages, your attorney must pursue your own underinsured motorist coverage, possibly file claims against other parties who share fault, and potentially prepare for trial to recover full compensation. Commercial vehicle accidents involving trucking companies, rideshare drivers, or delivery services introduce additional insurance layers, corporate defendants, and regulatory compliance issues that extend timelines but often justify the wait through substantially higher settlements.

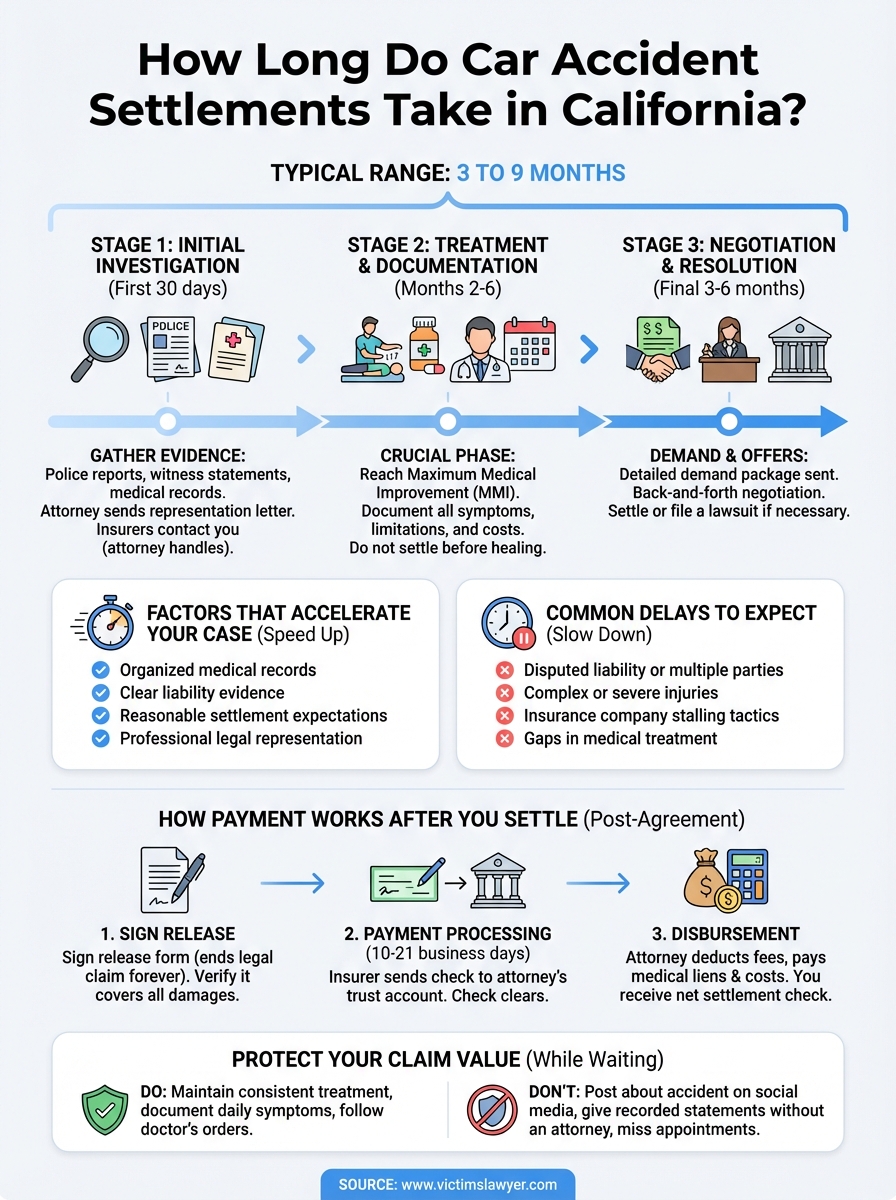

Typical settlement timeline in California

Most California car accident settlements take three to nine months from the date of the accident to final payment, though this range shifts dramatically based on your injury severity and insurance company cooperation. When clients ask how long do car accident settlements take, we explain that the process follows predictable phases, and understanding these stages helps you set realistic expectations while protecting your financial recovery.

First 30 days: Initial investigation phase

You spend the first month focused on medical care while your attorney handles the legal groundwork. Your lawyer sends a representation letter to all insurance companies, gathers the police report, secures witness statements, and begins collecting medical records. Insurance adjusters contact you (or try to), but your attorney shields you from statements that could damage your claim. This phase moves quickly because most documentation is readily available and doesn’t require waiting for treatment completion.

Months 2-6: Treatment and documentation

Your medical treatment determines this phase’s length. You continue seeing doctors, attending physical therapy, and documenting every symptom and limitation while your attorney builds the damages file. Minor soft tissue injuries often stabilize within two to four months, allowing faster settlement discussions. Serious injuries requiring surgery or specialized care extend this phase to six months or longer because settling before maximum medical improvement means leaving money on the table. Your attorney cannot make a credible demand until they can prove your total medical costs, lost wages, and permanent limitations.

Settling during active treatment forces you to guess at future medical needs, and insurance companies never compensate you for expenses you cannot yet prove.

Final 3-6 months: Negotiation and resolution

Once you complete treatment, your attorney sends a detailed demand package to the insurance company with medical records, bills, wage loss documentation, and a settlement figure. Insurers typically respond within 30 days, and serious negotiations begin. Straightforward cases with cooperative adjusters settle within 60 to 90 days of the demand. Disputes over liability or compensation value add months of back-and-forth negotiation or require filing a lawsuit to push toward trial.

What can speed up or slow down your case

You control some aspects of how long do car accident settlements take, while others depend on forces beyond your reach. Understanding which factors you can influence helps you make strategic decisions that protect your compensation without creating unnecessary delays. Smart victims focus their energy on the controllable elements while their attorney handles the insurance company tactics that slow progress.

Factors that accelerate settlements

Organized documentation moves your case faster than anything else. When you keep every medical record, prescription receipt, wage loss statement, and accident photo in one place, your attorney builds a compelling demand package without chasing missing paperwork. Cases with clear liability evidence (dashcam footage, police citations, witness statements) settle quicker because adjusters cannot fabricate reasonable disputes. Working with your lawyer also speeds resolution because you avoid giving recorded statements that insurance companies twist to reduce your payout, and your attorney handles all adjuster contacts so you can focus on healing.

Insurance companies delay cases when they sense confusion or desperation, but they settle faster when you demonstrate patience and professional representation.

Reasonable expectations about settlement value prevent months of wasted negotiation. If your damages total $75,000 and the at-fault driver carries $100,000 in coverage, accepting a fair offer near policy limits closes your case within weeks. Demanding $500,000 when evidence doesn’t support it forces unnecessary litigation that adds six to twelve months without improving your outcome.

Common delays to expect

Insurance companies deploy predictable stalling tactics. They request the same medical records multiple times, assign new adjusters mid-case who restart the review process, or suddenly question liability after months of silence. California’s two-year statute of limitations for most personal injury claims gives insurers room to delay, hoping you’ll accept a lowball offer out of financial desperation. Multiple defendants or complex injuries requiring expert testimony extend timelines legitimately, but you need an experienced attorney to distinguish justified delays from intentional obstruction designed to pressure you into settling cheap.

How payment works after you settle

Understanding the payment process after settlement prevents surprises when you finally receive your check. Many victims assume that agreeing to a settlement amount means immediate payment, but the reality involves several steps that add two to six weeks between signing documents and depositing your money. The good news is that once you reach agreement on how long do car accident settlements take, the final payment phase follows a predictable timeline with clear milestones.

Settlement release and documentation requirements

The insurance company sends a release form that legally closes your claim in exchange for the agreed settlement amount. You sign this document acknowledging that you accept the payment as full compensation for your injuries and agree not to pursue additional claims against the at-fault party. Your attorney reviews every line of the release before you sign because these documents sometimes include provisions that affect future medical claims or limit your ability to reopen the case if complications develop. Most releases are straightforward, but commercial vehicle accidents or cases involving multiple defendants may require more complex documentation.

Signing a release ends your legal claim forever, so you must verify the settlement amount covers all current and reasonably anticipated future damages.

Payment processing and distribution

Insurance companies typically issue settlement checks within 10 to 21 business days after receiving your signed release, though some carriers drag this out to 30 days. Your attorney deposits the check into their trust account, waits for it to clear (usually three to five business days), then disburses funds according to your agreement. Your lawyer deducts their contingency fee (typically 33% to 40%), pays any outstanding medical liens from hospitals or insurance companies, and sends you a detailed accounting with your remaining settlement check.

What reduces your final payment

Medical providers hold legal liens on your settlement for unpaid treatment costs, and health insurance companies can demand reimbursement for accident-related care they covered. Your attorney negotiates these liens down when possible, but you cannot ignore them. Outstanding case costs like expert witness fees, court filing charges, and record retrieval expenses also get deducted before you receive your net payment.

How to protect your claim while it moves

While waiting to learn how long do car accident settlements take in your specific case, you can damage your claim value through avoidable mistakes that insurance companies exploit. The settlement process creates a dangerous window where adjusters actively search for evidence to reduce your payout, and victims who don’t understand these tactics accidentally provide the ammunition used against them. Protecting your claim requires following specific rules from the accident date until you receive your final check, and violations of these guidelines can cost you tens of thousands of dollars in compensation.

Avoid actions that weaken your case

Insurance companies monitor your social media accounts looking for posts that contradict your injury claims. That vacation photo where you’re smiling at the beach becomes “proof” you’re not really suffering, even though it captured the one hour you felt decent during a week of pain. Set all social media accounts to private and avoid posting anything about your accident, injuries, activities, or settlement. Never give recorded statements to the at-fault driver’s insurance company without your attorney present because adjusters use leading questions to create contradictions they’ll replay at trial. These conversations are not casual inquiries, they’re evidence-gathering missions designed to reduce what the insurer pays you.

Insurance adjusters are trained to sound sympathetic while extracting statements that justify denying your claim or slashing your settlement offer.

Maintain consistent medical treatment and documentation

Gaps in your medical care signal to insurance companies that your injuries weren’t serious enough to require ongoing attention. Missing appointments or stopping treatment before your doctor recommends undermines your credibility and gives adjusters justification to argue you recovered faster than claimed. Follow every treatment recommendation, attend all scheduled appointments, and document every symptom you experience in a daily journal with dates and details. Keep copies of all medical bills, prescription receipts, and wage loss statements in one organized file your attorney can access immediately when building your demand package or responding to insurer requests.

What to do next

Understanding how long do car accident settlements take helps you plan financially and avoid pressure tactics from insurance adjusters who want you to settle before your case reaches full value. The timeline depends heavily on your medical treatment completion, liability clarity, and the insurance company’s willingness to negotiate fairly, but most California cases resolve within three to nine months when handled by experienced attorneys who protect your interests.

Waiting for your settlement creates stress, especially when bills pile up and adjusters make lowball offers. You need a legal team that fights for maximum compensation while keeping your case moving efficiently. Steven M. Sweat, Personal Injury Lawyers, APC has spent 25+ years securing hundreds of millions in settlements for California accident victims, and we never charge legal fees unless we recover money for you. Contact our Los Angeles personal injury attorneys today for a free consultation about your car accident claim and realistic timeline.